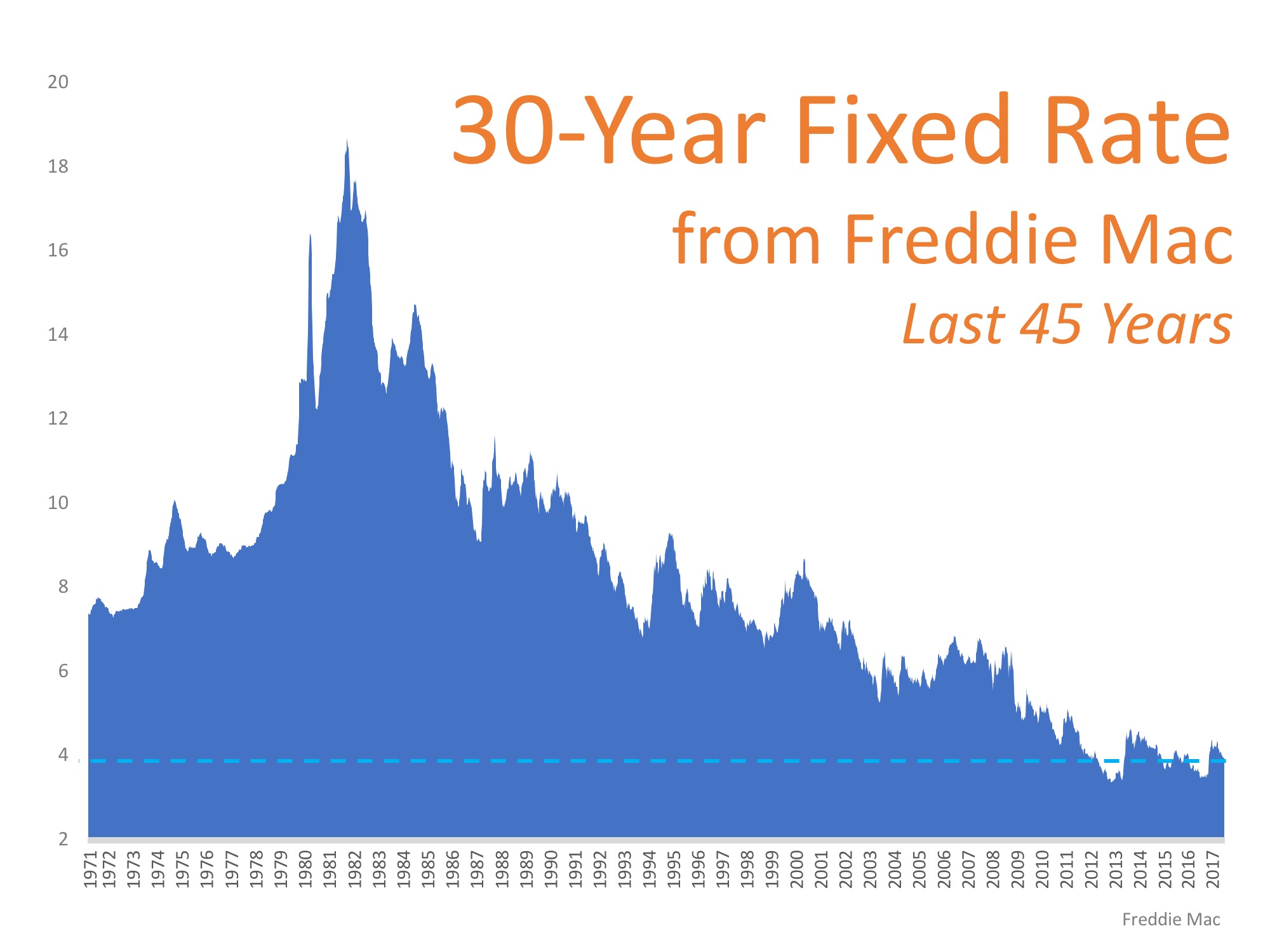

Interest rates have hovered around 4% for the majority of 2017, which has given many buyers relief from rising home prices and has helped with affordability. Experts predict that rates will increase by the end of 2017 and will be about three-quarters of a percentage point higher, at 4.5%, by the end of 2018.

Last week’s Freddie Mac Primary Mortgage Market Survey revealed that interest rates for a 30-year fixed rate mortgage have fallen to their lowest mark this year, at 3.88%. This is great news for homebuyers looking to purchase and homeowners looking to refinance.

The rate you secure greatly impacts your monthly mortgage payment and the amount you will ultimately pay for your home.

Let’s take a look at a historical view of interest rates over the last 45 years.

Bottom Line

Be thankful that you can still get a better interest rate than your older brother or sister did ten years ago, a lower rate than your parents did twenty years ago, and a better rate than your grandparents did forty years ago.